The Risks of Operating Without an Asset Investment Plan

Introduction

For organizations across industries, the management and maintenance of assets play a critical role in ensuring operational efficiency, minimizing downtime, and maximizing the value of investments. An effective asset investment plan (AIP) provides a roadmap for optimizing asset performance, allocating resources strategically, and mitigating risks. However, operating without a well-defined AIP exposes organizations to a range of risks that can have significant consequences. In this blog article, we will explore the risks associated with not having an AIP and highlight the importance of implementing this essential asset management tool.

- Reactive Maintenance and Higher Costs: Without an AIP in place, organizations often resort to reactive maintenance practices, addressing issues as they arise rather than proactively managing assets. This reactive approach leads to higher costs, as emergency repairs are usually more expensive than planned maintenance. Without a clear plan for allocating resources and scheduling maintenance activities, organizations may experience unexpected breakdowns, equipment failures, and disruptions to operations, resulting in increased downtime and lost productivity.

- Inefficient Resource Allocation: An AIP provides organizations with a systematic framework for allocating resources, including financial, human, and material resources. Without an AIP, resource allocation becomes ad hoc and less strategic, leading to inefficiencies and suboptimal use of resources. Organizations may end up overspending on certain assets while neglecting others, leading to imbalances in asset performance, potential bottlenecks, and missed opportunities for optimization and cost savings.

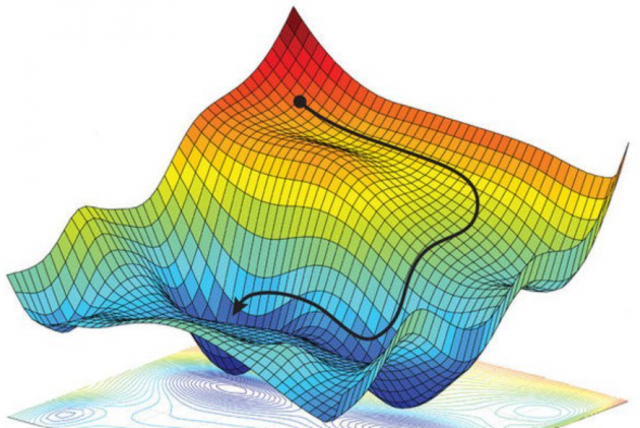

- Poor Asset Performance and Reduced Lifespan: Operating without an AIP increases the risk of poor asset performance and a shortened lifespan. Assets that are not properly maintained or optimized may experience increased wear and tear, decreased reliability, and decreased performance over time. Without a plan for regular inspections, preventive maintenance, and asset upgrades, organizations may face more frequent breakdowns, costly repairs, and the need for premature asset replacements. This not only affects operational efficiency but also results in higher lifecycle costs and reduced return on investment.

- Compliance and Regulatory Risks: Many industries are subject to specific regulations and compliance requirements related to asset management, environmental standards, and health and safety. Without an AIP, organizations may struggle to meet these obligations, exposing themselves to compliance risks and potential legal and financial consequences. An AIP helps organizations establish processes and documentation to ensure compliance, track asset conditions, perform audits, and demonstrate adherence to regulations.

- Missed Opportunities for Strategic Planning and Growth: An AIP goes beyond day-to-day maintenance activities and extends to long-term strategic planning. Without an AIP, organizations may miss opportunities for growth, optimization, and innovation. An AIP allows organizations to align their asset investments with strategic objectives, identify opportunities for technology upgrades or asset replacements, and make informed decisions about capital expenditure. Without this roadmap, organizations may find it challenging to stay competitive, adapt to changing market conditions, or take advantage of emerging technologies.

Conclusion

Operating without an Asset Investment Plan exposes organizations to a range of risks that can negatively impact operational efficiency, financial performance, and long-term sustainability. A well-defined AIP enables organizations to take a proactive approach to asset management, optimize performance, allocate resources strategically, and mitigate risks. By implementing an AIP, organizations can reduce reactive maintenance, optimize resource allocation, extend asset lifespans, ensure compliance, and seize strategic opportunities for growth and innovation. Embracing an AIP as an integral part of asset management is a key step towards achieving operational excellence, reducing costs, and maximizing the value of investments.