Harnessing the Power of Simulation and Statistical Analysis in AIP: Unlocking Optimal Decision-Making

Introduction

Asset Investment Planning (AIP) plays a pivotal role in optimizing resource allocation and decision-making for asset management. To ensure robust and informed decision-making, it is essential to run multiple simulations during the AIP process and employ statistical analysis to evaluate the simulation results. In this blog post, we will explore the importance of running multiple simulations and statistically analyzing the results over many trials, highlighting the benefits of this approach in driving optimal asset management decisions.

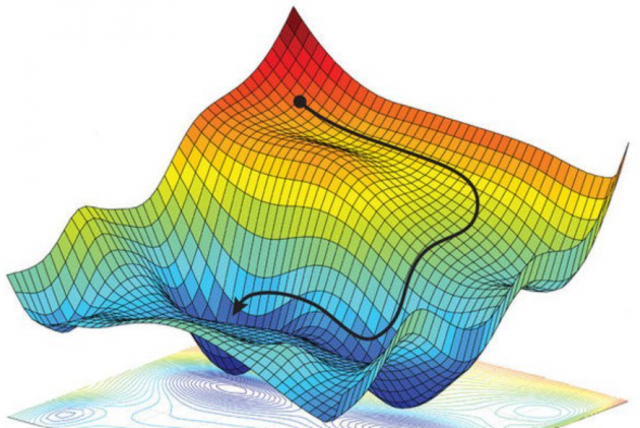

- Capturing Uncertainty and Variability: Asset management decisions are inherently influenced by various uncertainties and variables, such as asset performance, market conditions, and resource availability. By running multiple simulations, organizations can capture this uncertainty and variability, providing a more comprehensive understanding of the potential outcomes and risks associated with different investment strategies. This approach enables decision-makers to make informed choices that are robust and resilient to uncertainties.

- Identifying Trends and Patterns: Running simulations across multiple trials allows for the identification of trends and patterns in the simulation results. Statistical analysis techniques, such as regression analysis, correlation analysis, and time-series analysis, can uncover valuable insights into the relationships between different variables and their impact on asset performance. These insights can guide decision-makers in understanding the factors that drive asset performance and help them develop effective strategies to optimize performance and mitigate risks.

- Assessing Confidence and Reliability: Statistical analysis of simulation results provides a quantitative assessment of confidence and reliability. By analyzing the distribution of outcomes, organizations can determine the likelihood of achieving desired performance targets or meeting specified levels of service. Confidence intervals, probability distributions, and reliability curves can be generated to quantify the level of confidence and the probability of success associated with different investment options. This information empowers decision-makers to make risk-informed decisions based on a comprehensive understanding of potential outcomes.

- Evaluating Trade-offs and Sensitivity Analysis: Running simulations and conducting statistical analysis allow for comprehensive trade-off evaluations and sensitivity analysis. Decision-makers can explore different investment scenarios, consider various constraints and objectives, and assess the impact of changing assumptions or parameters on the simulation results. Sensitivity analysis helps identify critical variables that significantly influence the outcomes and enables decision-makers to prioritize their focus and resources accordingly. This analysis ensures that decisions are based on a thorough understanding of the trade-offs involved and their potential impact on asset performance.

- Facilitating Continuous Improvement: The use of simulation and statistical analysis in AIP facilitates a culture of continuous improvement. By comparing simulation results from different trials, organizations can track progress over time and assess the effectiveness of implemented strategies. This iterative process enables organizations to learn from past experiences, refine their models and assumptions, and continuously enhance their decision-making capabilities. The ability to statistically analyze simulation results provides valuable feedback for refining asset management plans and adapting strategies to evolving circumstances.

Conclusion

Running multiple simulations and leveraging statistical analysis in the AIP process is crucial for optimizing asset management decisions. By capturing uncertainty, identifying trends and patterns, assessing confidence and reliability, evaluating trade-offs, and facilitating continuous improvement, organizations can make informed decisions that maximize asset performance, mitigate risks, and align with their strategic objectives. Embracing simulation and statistical analysis empowers decision-makers to navigate complex asset management challenges and unlock optimal outcomes in an ever-changing landscape.