Exploring Optimization Techniques in Asset Investment Planning: A Comparative Analysis

Introduction

Asset Investment Planning (AIP) involves making strategic decisions on how to allocate limited resources to optimize the performance and value of assets. To assist in this process, various optimization techniques are available, each with its strengths and limitations. In this blog post, we will compare and contrast four popular optimization techniques used in AIP: greedy algorithm, linear programming, simulated annealing, and machine learning. By understanding the characteristics of each approach, organizations can choose the most suitable technique based on their specific needs and goals.

- Greedy Algorithm: The greedy algorithm is a straightforward approach that makes locally optimal decisions at each step to solve a larger problem. In AIP, it involves selecting the next investment or action that provides the most immediate benefit without considering the long-term implications. While the greedy algorithm is simple and computationally efficient, it may not always result in the best overall solution as it fails to consider global optimization.

- Linear Programming: Linear programming is a mathematical optimization technique that aims to find the optimal solution to a problem with linear constraints. It involves formulating an objective function and a set of linear constraints and then determining the values of decision variables that maximize or minimize the objective function. Linear programming is suitable for AIP as it can handle multiple constraints and provide an optimal solution, considering both short-term and long-term goals.

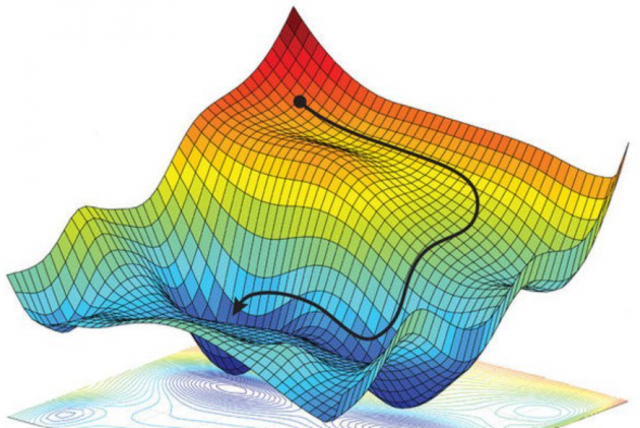

- Simulated Annealing: Simulated annealing is a probabilistic optimization technique inspired by the annealing process in metallurgy. It starts with an initial solution and explores the solution space by allowing occasional uphill moves to escape local optima. Over time, the algorithm converges towards an optimal or near-optimal solution. Simulated annealing is particularly useful when searching for global optima in large solution spaces and can handle non-linear objective functions. However, it can be computationally expensive and requires careful tuning of parameters.

- Machine Learning: Machine learning techniques, such as reinforcement learning or genetic algorithms, can also be applied in AIP. These techniques use historical data and patterns to make predictions and optimize decision-making processes. Machine learning algorithms can learn from past investment decisions, asset performance data, and external factors to recommend optimal investment strategies. They can handle complex non-linear relationships and adapt to changing environments. However, machine learning approaches require substantial amounts of high-quality data for training and can be computationally intensive.

Comparative Analysis

- Computational Complexity: Greedy algorithms are computationally efficient but may not provide the best overall solution. Linear programming and simulated annealing can handle more complex problems but may require longer computation times. Machine learning algorithms can be computationally expensive, especially during the training phase.

- Flexibility: Linear programming and machine learning offer flexibility in modeling complex relationships and constraints. Simulated annealing is flexible in handling non-linear objective functions and searching for global optima. Greedy algorithms are simple but limited in their flexibility.

- Solution Quality: Linear programming and machine learning approaches can provide optimal or near-optimal solutions. Simulated annealing can reach good solutions but may not guarantee optimality. Greedy algorithms provide locally optimal solutions but may fall short of global optimality.

- Data Requirements: Machine learning techniques require large amounts of quality data for training and may struggle with limited or incomplete data. Linear programming and simulated annealing require less data and focus more on mathematical optimization.

Conclusion

Each optimization technique - greedy algorithm, linear programming, simulated annealing, and machine learning - offers distinct advantages and trade-offs in the context of Asset Investment Planning. The choice of technique depends on the specific requirements, constraints, and objectives of the organization. Linear programming provides an optimal solution with flexibility in handling constraints, while simulated annealing explores larger solution spaces. Machine learning leverages historical data to make predictions and recommendations, but it requires significant data resources. Understanding the strengths and limitations of each technique empowers organizations to select the most suitable approach to enhance their AIP strategies and achieve optimal resource allocation for long-term asset performance and value.