The Benefits of Cross-Category modeling in Asset Investment Planning

Asset Investment Planning (AIP) is a complex process that involves strategically allocating resources for the management and maintenance of an organization's asset portfolio. A crucial aspect of effective AIP is cross-category modeling, which allows for the consideration of interdependencies and interactions between different asset categories. In this article, we will explore the benefits of cross-category modeling in the AIP process and how it can enhance decision-making and optimize asset performance.

1. Comprehensive Analysis of Asset Interdependencies

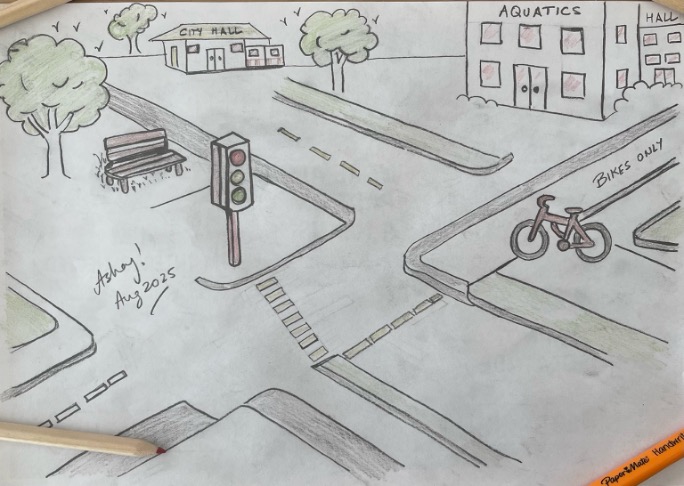

Cross-category modeling enables a comprehensive analysis of asset interdependencies within an organization. Assets from different categories, such as transportation, facilities, water, and sewer, often interact with each other in complex ways. By considering these interdependencies during the AIP process, organizations can gain valuable insights into how changes or investments in one asset category may impact others. This holistic view allows for more informed decision-making and reduces the risk of unintended consequences.

2. Optimal Allocation of Resources

With cross-category modeling, organizations can optimize the allocation of resources across different asset categories. By understanding the relationships and dependencies between assets, decision-makers can prioritize investments and allocate resources where they are most needed. For example, if an investment in transportation infrastructure positively impacts both transportation assets and facilities, the AIP process can identify the optimal allocation of funds to maximize the benefits across multiple categories. This leads to a more efficient use of resources and improved asset performance.

3. Identification of Synergies and Trade-offs

Cross-category modeling allows organizations to identify synergies and trade-offs between different asset categories. By analyzing the relationships and interactions between assets, decision-makers can uncover opportunities to leverage investments in one category to achieve benefits in another. For example, upgrading water and sewer infrastructure may have positive effects on both facilities and transportation, such as improved maintenance and reduced operational costs. On the other hand, there may be trade-offs where investments in one category could have negative impacts on others. By identifying these synergies and trade-offs, organizations can make more informed decisions and optimize their asset management strategies.

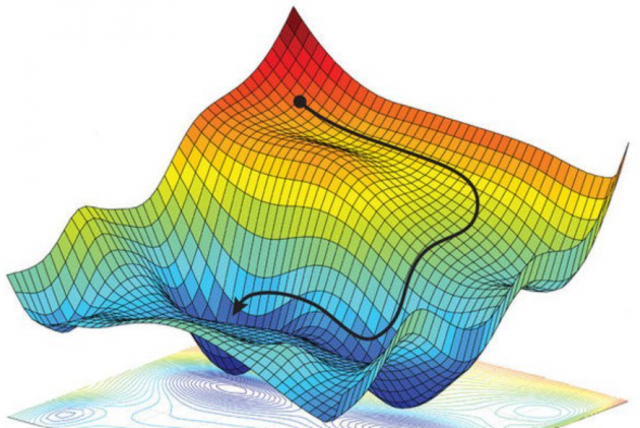

4. Improved Risk Management

Cross-category modeling enhances risk management in the AIP process. By considering the interdependencies between assets, organizations can assess and mitigate risks more effectively. For example, if a major transportation asset fails, it may have cascading effects on other categories, such as facilities and water systems. Through cross-category modeling, organizations can identify potential vulnerabilities and develop risk mitigation strategies that address the broader impact on the asset portfolio. This proactive approach helps organizations enhance the resilience and reliability of their assets.

Conclusion

Cross-category modeling is a valuable tool in Asset Investment Planning, enabling organizations to gain a comprehensive understanding of asset interdependencies, optimize resource allocation, and make informed decisions. By considering the interactions between different asset categories, organizations can achieve synergies, mitigate risks, and maximize the performance and longevity of their asset portfolio. Incorporating cross-category modeling into the AIP process is an essential step towards effective asset management and sustainable growth.