The Vital Role of Asset Investment Planning (AIP) in Effective Asset Management

Introduction

Asset management is a critical function for organizations across various industries, including government agencies, utilities, transportation, and facilities. It involves optimizing the performance, reliability, and cost-effectiveness of assets throughout their life cycle. One essential component of successful asset management is Asset Investment Planning (AIP). In this blog post, we will explore the importance of AIP as an integral part of comprehensive asset management strategies.

Strategic Decision-Making

AIP plays a pivotal role in facilitating strategic decision-making for asset management. It provides a structured approach to analyze asset data, performance metrics, and financial considerations. By leveraging AIP methodologies, organizations can prioritize and plan their investments based on the criticality and condition of assets, budget constraints, and service level requirements. AIP enables informed decisions about asset maintenance, replacements, and capital investments, ensuring optimal allocation of resources and long-term sustainability.

Optimal Resource Allocation

Efficient resource allocation is crucial for effective asset management, and AIP helps organizations achieve this goal. By integrating asset data and performance indicators, AIP enables organizations to identify areas that require the most attention and allocate resources accordingly. AIP provides insights into asset condition, risk levels, and maintenance requirements, allowing organizations to optimize the utilization of their workforce, materials, and equipment. This ensures that resources are allocated where they are most needed, minimizing costs and maximizing operational efficiency.

Lifecycle Cost Management

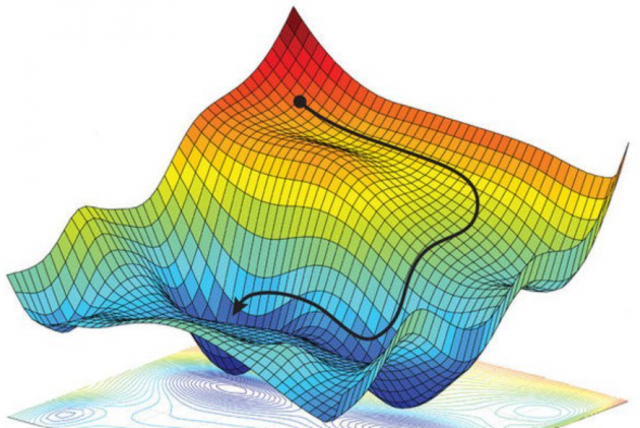

AIP facilitates comprehensive lifecycle cost management for assets. It allows organizations to assess the costs associated with owning, operating, maintaining, and renewing assets over their entire lifespan. By considering factors such as maintenance needs, replacement cycles, and technological advancements, AIP helps organizations develop long-term investment strategies that minimize total lifecycle costs. AIP supports data-driven decision-making that takes into account the financial implications of different asset management scenarios, allowing organizations to make informed choices to optimize costs.

Risk Mitigation

Effective risk management is a key component of asset management, and AIP plays a crucial role in identifying and mitigating risks. AIP enables organizations to assess risks associated with asset failures, regulatory compliance, safety, and environmental impacts. By integrating risk analysis into the decision-making process, AIP helps organizations prioritize investments in high-risk assets, plan for preventive maintenance, and implement strategies to mitigate potential risks. This proactive approach minimizes the likelihood of costly failures, disruptions, and regulatory penalties.

Performance Monitoring and Improvement

AIP provides a framework for ongoing performance monitoring and improvement. By establishing performance metrics, targets, and benchmarks, organizations can measure the effectiveness of their asset management strategies. AIP enables organizations to track asset performance, evaluate the outcomes of investment decisions, and make adjustments as needed. Continuous monitoring allows organizations to identify areas for improvement, optimize asset performance, and make data-driven decisions to enhance service levels while minimizing costs.

Conclusion

Asset Investment Planning (AIP) is a critical component of effective asset management. It supports strategic decision-making, optimal resource allocation, lifecycle cost management, risk mitigation, and performance monitoring. By integrating AIP into their asset management practices, organizations can make informed decisions, optimize costs, improve asset performance, and ensure the long-term sustainability of their assets. AIP empowers organizations to proactively manage their assets, align their investments with strategic objectives, and deliver optimal service levels while maximizing cost-effectiveness.