The Impact of No Asset Investment Planning (AIP) on the World

Introduction

Asset Investment Planning (AIP) is a critical process that organizations undertake to strategically manage and invest in their assets. It involves assessing asset conditions, prioritizing investments, and allocating resources to ensure the long-term sustainability and performance of assets. In this blog post, we explore the hypothetical scenario of a world without Asset Investment Planning and the potential consequences it would bring.

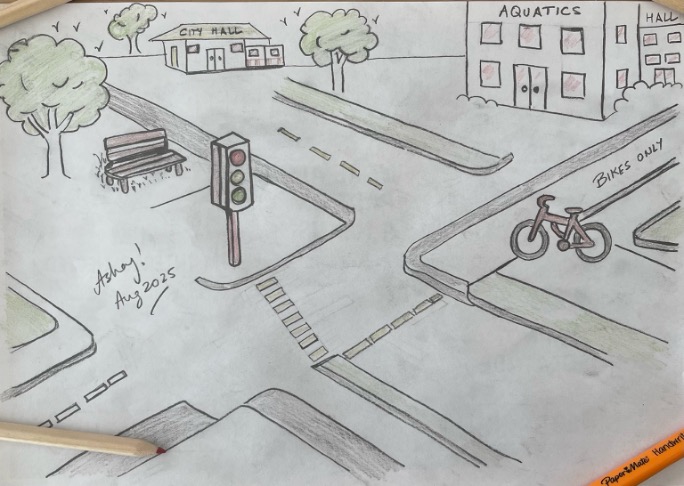

Deteriorating Infrastructure

In the absence of AIP, infrastructure assets worldwide would likely face a steady decline in condition and performance. Without a systematic approach to assess and prioritize investments, infrastructure would become increasingly susceptible to deterioration, leading to frequent failures, disruptions in service, and compromised safety. The lack of proactive maintenance and replacement strategies would result in higher costs associated with emergency repairs and asset failures.

Inefficient Resource Allocation

Without AIP, organizations would struggle to allocate resources efficiently. The lack of data-driven insights and analysis would lead to ad-hoc decision-making and resource allocation based on immediate needs or political pressures. As a result, limited resources would not be optimally distributed among assets, leading to inefficiencies, underinvestment in critical assets, and overinvestment in less essential ones.

Unpredictable Service Levels

AIP provides a framework for organizations to define and maintain desired service levels for their assets. Without AIP, service levels would become unpredictable and inconsistent. The lack of strategic planning and investment would result in varying levels of asset performance and service quality, impacting businesses, communities, and individuals. Some areas might experience substandard service, while others might receive excessive investment, leading to inequitable outcomes.

Higher Costs and Financial Burden

The absence of AIP would likely lead to higher costs and an increased financial burden on organizations and society as a whole. Reactive and unplanned investments would be costly, as emergency repairs and asset replacements tend to be more expensive than proactive maintenance. Additionally, the lack of long-term financial planning and risk assessment would result in higher borrowing costs, increased debt, and a reduced ability to respond to financial shocks.

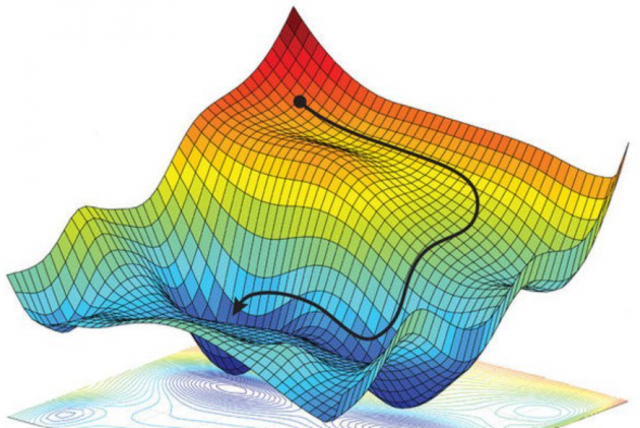

Lack of Data-Driven Decision-Making

AIP relies on data analysis, modeling, and forecasting to support decision-making. Without AIP, organizations would lack the necessary data-driven insights to make informed decisions. The absence of data analytics and optimization tools would hinder the ability to assess trade-offs, identify cost-effective investment strategies, and align investments with organizational goals. The decision-making process would be more subjective and vulnerable to biases.

Conclusion

Asset Investment Planning (AIP) is vital for maintaining the performance, safety, and sustainability of assets. In a world without AIP, infrastructure would deteriorate, resources would be allocated inefficiently, service levels would be unpredictable, costs would soar, and decision-making would be less informed. AIP provides the framework for organizations to strategically manage their assets, optimize investments, and ensure the long-term well-being of both physical infrastructure and the communities that rely on them.